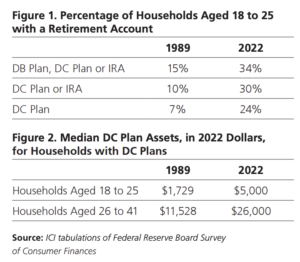

Recent research from the Investment Company Institute (ICI)2 finds that the long-term financial outlook for younger generations is more promising than had been previously assumed. Despite managing what is for many substantial student loan debt while attempting to get a head start on careers and families, researchers at ICI say that this demographic have made “more progress in retirement savings than prior generations had at the same stage of life.”

The research specifically noted that both retirement account ownership and asset accumulation among younger US households have trended higher in recent decades.

ICI’s researchers attribute the high rates of account ownership and asset accumulation of Gen Z individuals to the prevalence of defined contribution (DC) plans, which usually offer employer contributions, and have overtaken defined benefit plans as the primary type of private-sector workplace retirement plan. The data shows that the percentage of Gen Z households with DC plan accounts is more than three times that of similar-age Gen X households in 1989.

The researchers also cite automatic enrollment as playing a role in boosting DC retirement account ownership. In fact, tabulations from the ICI Annual Mutual Fund Shareholder Tracking Survey cited by the study’s authors found that more than half of DC-owning households younger than 35 in 2023 reported they had been automatically enrolled.

In addition, the ICI researchers noted that Gen Z households prioritize retirement saving more often than similar-age Gen Z households in 1989. Based on ICI tabulations of the Federal Reserve Board’s Survey of Consumer Finances, nine percent of households aged 18 to 25 in 2022 cited retirement as the primary reason for family saving compared to two percent of similar-age households in 1989.

The critical role of DC plans

Other research conducted by ICI3 underscores how critically important DC plans are to young Americans’ financial future. The research found that more than half of DC account owners younger than 35 say that they probably would not save for retirement were it not for their workplace plan. More than 75% of the same cohort said that the tax treatment of their retirement plans is a big incentive to contribute. And 84% of DC account owners under age 35 agreed that their plan helps them think about the long term, not just their current needs.

Plan sponsors who find that their employee participation and/or contribution rates are lower than they would like (not just for Gen Z employees but for all other employee demographic groups) may want to revisit and reevaluate elements of their retirement plans. It may require broader investment choices, a bigger employee match, automatic features and an enhanced financial wellness education program to help move the needle.